Business Insurance in and around Port Angeles

Calling all small business owners of Port Angeles!

Insure your business, intentionally

Your Search For Excellent Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, a surety or fidelity bond and extra liability coverage, you can feel comfortable that your small business is properly protected.

Calling all small business owners of Port Angeles!

Insure your business, intentionally

Get Down To Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Matt Zdroik for a policy that safeguards your business. Your coverage can include everything from a surety or fidelity bond or worker's compensation for your employees to employment practices liability insurance or professional liability insurance.

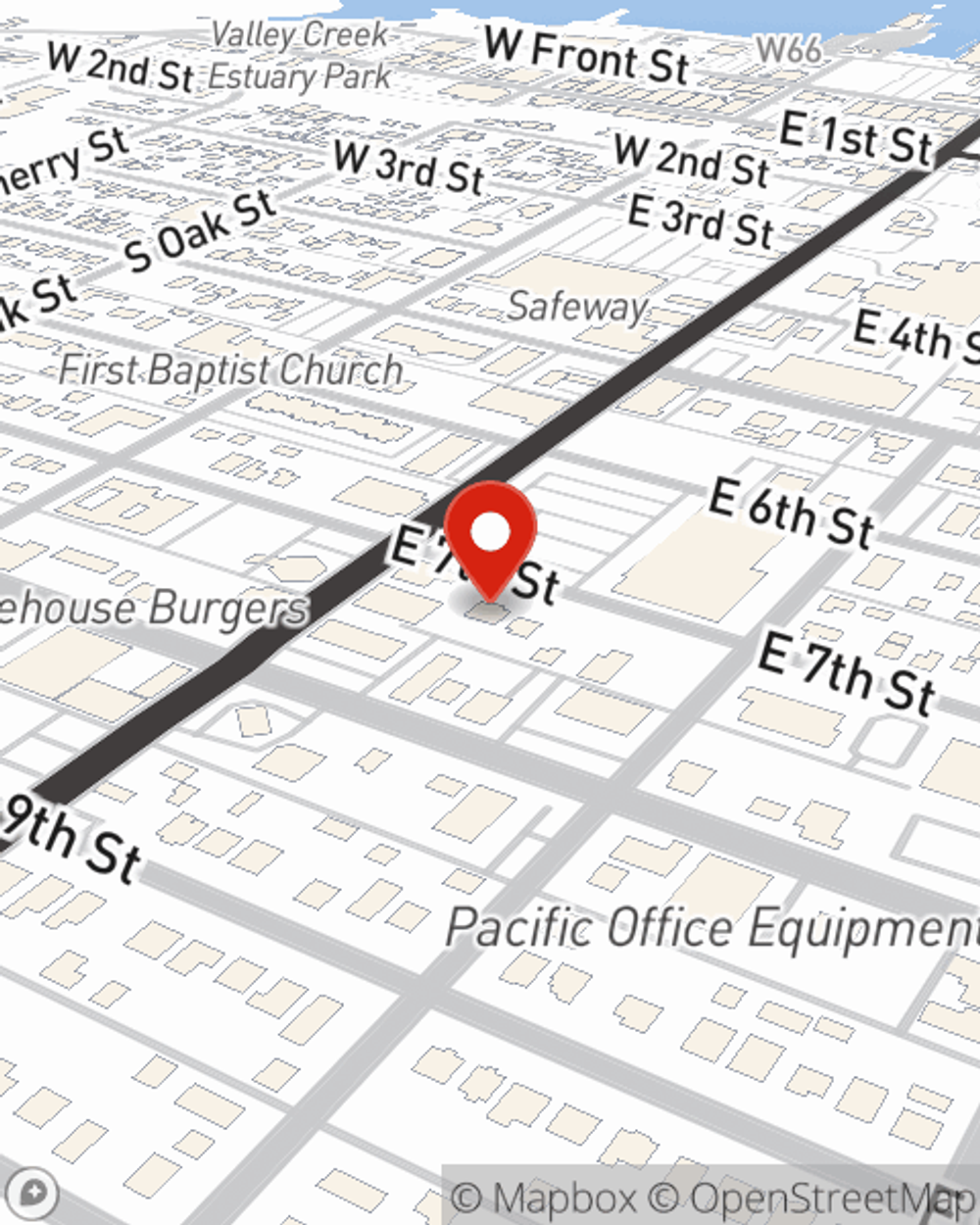

Ready to talk through the business insurance options that may be right for you? Stop by agent Matt Zdroik's office to get started!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Matt Zdroik

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.